Frequent Flyers’ Guide to 2025 IRS Mileage Rates

The IRS has just announced new 2025 mileage rates that can help frequent flyers save on taxes. Learn how to track every mile and claim the best deduction.

The IRS has just announced new 2025 mileage rates that can help frequent flyers save on taxes. Learn how to track every mile and claim the best deduction.

Capital One’s business cards help turn everyday expenses into remarkable travel benefits. Discover how businesses like Quantious use them to fuel culture and adventure.

Master these core competencies to plan cost-effective, stress-free corporate trips. From adept negotiation to cutting-edge tech, discover how top travel managers stay ahead.

Business travelers heading to the U.S. face a complex set of requirements. These seven essentials help frequent flyers clear each hurdle with confidence.

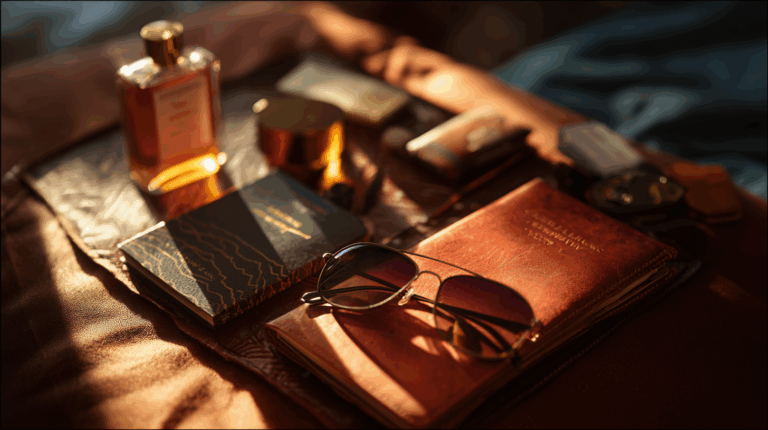

Pack lighter, stay productive, and breeze through every trip. Explore these curated must-haves for mastering business travel in style.

Explore rugged yet refined duffels that blend style, practicality, and durability. From water-resistant favorites to sleek leather standouts, these picks keep any professional traveler organized on the move.

Business travel is on a thrilling ascent, guided by AI, sustainability, and experiential “bleisure” adventures. This forward-looking landscape promises streamlined booking, meaningful connections, and improved ROI for savvy professionals.

Writing off travel can feel complicated, but it doesn’t have to ground your bottom line. Discover how to claim ordinary and necessary expenses while keeping flight plans intact.

Seat5A breaks down the latest IRS rates and rules for business travel mileage. Learn how to maximize deductions, maintain accurate records, and reimburse expenses like a pro.

Discover how to plan ahead, pack smart, and maximize efficiency on every corporate trip. From security checks to expense management, here’s everything you need to know.

Frequent flyers often juggle business with compliance, but the IRS has rules for deducting travel costs. Here’s a handy roadmap to keep more money in your pocket.

Wondering which travel costs qualify as legitimate business expenses? Here’s a practical look at IRS rules that can help frequent flyers make the most of their next work trip.